Processing 1099s

.

Navigate to Accounting > Cash and Bank > 1099’s >1099 Processing

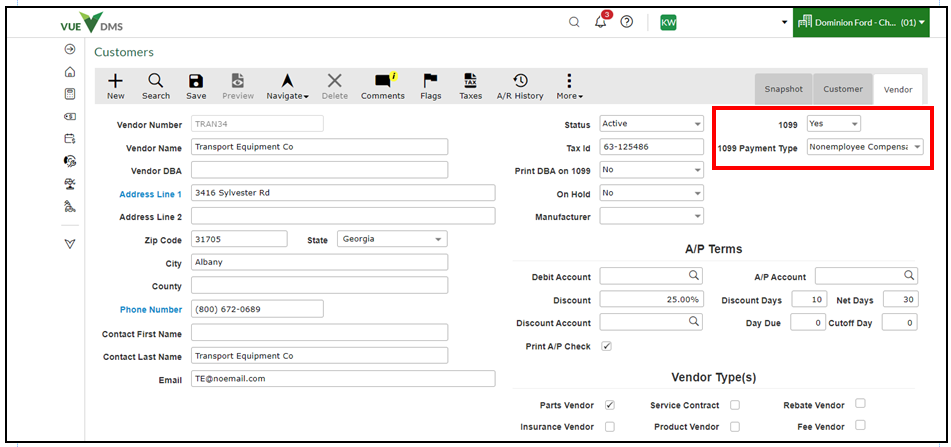

The Vendor record needs to have the Tax ID, 1099 yes, and 1099 Payment Type fields completed when a Vendor will be owed a 1099.

When these fields are defined, the information defaults to Manual Checks and Accounts Payable Invoices for the Vendor. The data on a vendor’s 1099 populates from payments made from Manual Checks or Accounts Payable that were defined as 1099 for the vendor within the last year.

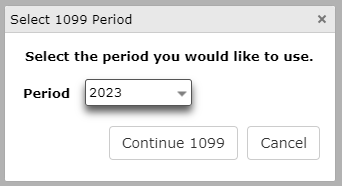

- After navigating to 1099 Processing, select the period to use.

2. Use the [Start Over] or [Refresh Data] buttons in the Action Ribbon as needed.

3. You may create an Excel spreadsheet by clicking on the [List 1099 Data] button.

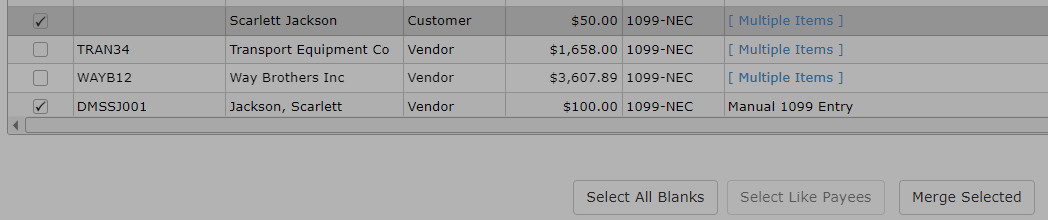

4. If a Payee is in the grid multiple times and needs to be merged, select the checkbox to the left of the Payee Number and then click the [Merge Selected] button at the bottom.

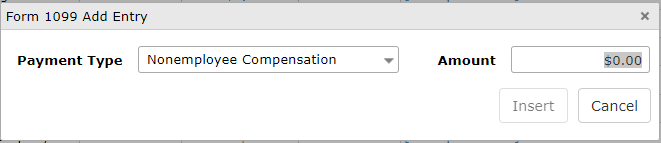

5. You can add an entry by selecting [Add Entry] at the bottom of the screen. Then select the payee that needs to be added from the grid that pops up. Then select the Payment Type and Amount and click the [Insert] button.

6. Once all entries are completed, select either [Print 1099s] or [eFile 1099s] from the Action Ribbon.

- If Print 1099s is selected, you receive a popup asking, "Which 1099 form do you want to print?" Select the 1099 form to print. Be sure the 1099 forms are aligned correctly and print forms.

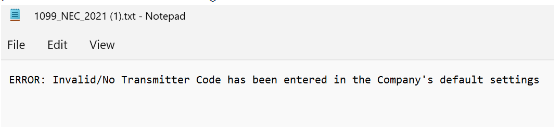

- If you want to eFile, click on the [eFile 1099s] button in the Action Ribbon. You will be prompted as to which form you want to file. Choose MISC, NEC, or Combined.

- After choosing, the next prompt asks if this is a Test File. Select Yes or No.

- Once selected, a file downloads to your default folder. This file will let you know if it can be submitted or if there is a problem. You will receive a message about the status of the Test File.