Payroll Year-End W-2 ACA Information Return

Generate and Submit Affordable Care Act (ACA) Compliance Data to the IRS.

The ACA Information Return (AIR) process is used to generate and submit Affordable Care Act (ACA) compliance data to the IRS. This report includes employee health coverage details required for Forms 1094-C and 1095-C, ensuring compliance with ACA regulations for applicable large employers.

When to Use It

- Year-End ACA Filing: To prepare and submit ACA data to the IRS for compliance with health coverage reporting requirements.

- Employee Forms Distribution: To provide employees with their ACA forms (1095-C) for personal tax filing.

- Audit Preparation: To confirm ACA data accuracy before submission to the IRS and employees.

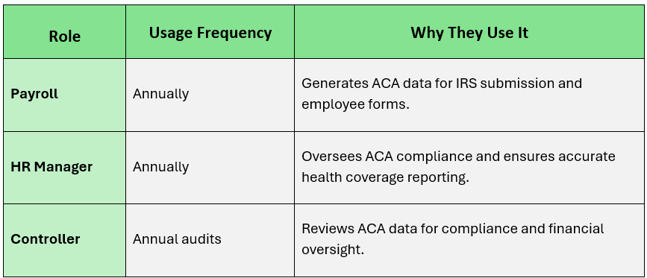

Who Uses the ACA Information Return, How Often, and Why