Payroll Unemployment/Insurance Deductions Report

Payroll Data Used to Calculate State Unemployment Insurance (SUI) Contributions

The Unemployment/Insurance Deductions Report provides a summary of payroll data used to calculate state unemployment insurance (SUI) contributions. It includes taxable wages, exemptions, and estimated amounts due for the selected period. This report ensures compliance with state unemployment regulations and supports accurate reporting to state agencies.

When to Use It

- Quarterly or Annual Tax Filing: To prepare and verify SUI contributions for state unemployment filings.

- Audit Preparation: To provide detailed unemployment insurance records for internal or external audits.

- Financial Reconciliation: To reconcile unemployment insurance liabilities with payroll and accounting records.

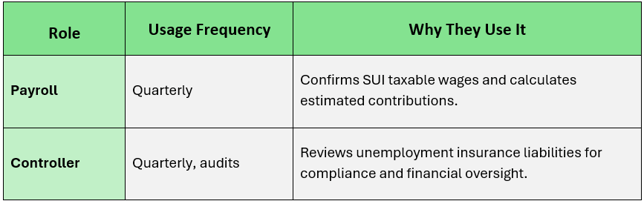

Who Uses the Unemployment/Insurance Deductions Report, How Often, and Why