Payroll Register Taxes Report

Summary of Payroll Tax Withholding

The Payroll Register Taxes Report provides a detailed summary of payroll tax withholdings and employer tax contributions for each employee over a selected period. This report is essential for tracking compliance with federal, state, and local tax regulations, supporting financial reconciliation, and preparing for audits.

When to Use It

- Tax Filing & Compliance: To verify payroll tax withholdings and employer contributions for quarterly or annual tax filings.

- Audit Preparation: To provide a clear record of payroll tax activity for internal or external audits.

- Financial Reconciliation: To reconcile payroll tax liabilities with accounting records.

- Management Review: To monitor tax trends and ensure proper deductions are being made for all employees.

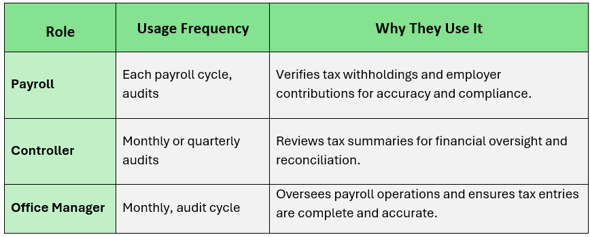

Who Uses the Payroll Register Taxes Report, How Often, and Why

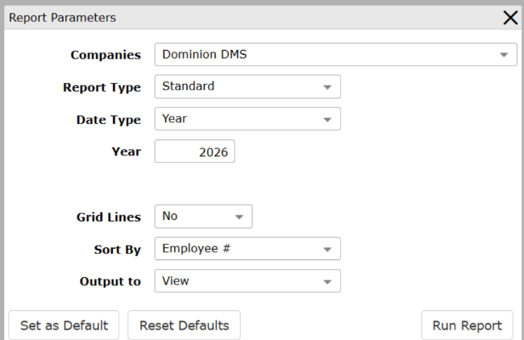

Navigate to: Accounting > Payroll > Reports >Payroll Register Taxes

Choose Parameters

This section clarifies the parameters outlined in this report. For additional details that apply to all reports, please refer to the Common Report Features article.

Report Type determines the format of the tax report.

-

Standard: Displays payroll tax information in a formatted report view

-

Export: Generates a spreadsheet-friendly version of payroll tax data