Payroll Quarterly Totals Report

Summary of Payroll Activity for the Selected Quarter

The Quarterly Totals Report provides a consolidated summary of payroll activity for the selected quarter. It includes total wages, tax liabilities, and employer/employee contributions for Social Security and Medicare. This report is essential for quarterly tax filings, financial reconciliation, and compliance with federal and state regulations.

When to Use It

- Quarterly Tax Filing: To verify totals for federal and state tax returns.

- Audit Preparation: To provide summarized payroll data for internal or external audits.

- Financial Reconciliation: To reconcile payroll expenses and tax liabilities with accounting records.

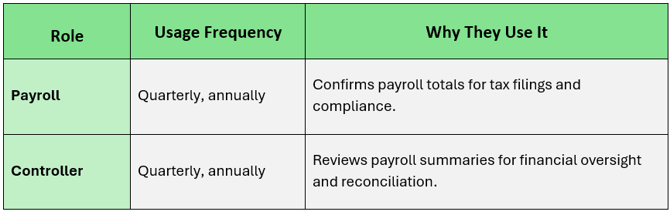

Who Uses the Quarterly Totals Report, How Often, and Why