Payroll Local Withholding Report

Summary of Local Tax Withholdings for Employees

The Payroll Local Withholding Report provides a summary of local tax withholdings for employees during a selected date range. This report is essential for ensuring compliance with local tax regulations, preparing local tax filings, and reconciling payroll tax liabilities.

When to Use It

- Local Tax Filing: To prepare and verify local withholding amounts for monthly, quarterly, or annual filings.

- Audit Preparation: To provide detailed local tax records for internal or external audits.

- Financial Reconciliation: To reconcile local tax liabilities with accounting records.

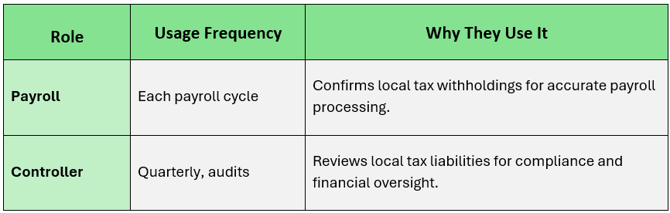

Who Uses the Local Withholding Report, How Often, and Why