Payroll Account Distribution Report

Breakdown of Payroll Expenses

The Account Distribution Report provides a detailed breakdown of payroll expenses allocated to various general ledger (GL) accounts. It shows how employee wages, deductions, and contributions are distributed across accounting codes for accurate financial reporting and reconciliation.

When to Use It

- Payroll Posting to GL: To verify payroll expense allocations before posting to the general ledger.

- Financial Reconciliation: To reconcile payroll costs with accounting records.

- Audit Preparation: To provide detailed payroll distribution data for internal or external audits.

- Departmental Analysis: To review payroll costs by department or cost center.

Who Uses the Account Distribution Report, How Often, and Why

Navigate to: Accounting > Payroll > Reports >Payroll Account Distribution

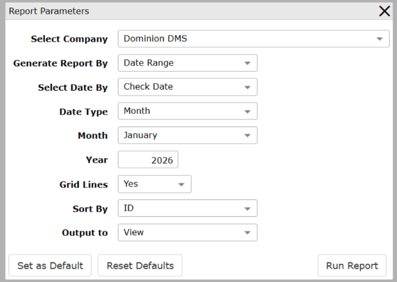

Choose Parameters

This section clarifies the parameters outlined in this report. For additional details that apply to all reports, please refer to the Common Report Features article.

-

Report Type determines the level of detail included.

-

Summary: Displays total payroll amounts by employee

-

Detail: Displays payroll totals with supporting detail

-

-

Select Employee determines which employees are included.

-

All: Includes all employees

-

Select: Allows selection of specific employees

-

-

Employee Status Filters employees based on status.

-

All: Includes active and inactive employees

-

Active: Includes active employees only

-

Inactive: Includes inactive employees only

-