IRS Form 941 Report Updates-July 2020

In response to FFRCA, CARES Act Tax Credits, and advanced payments related to Form 7200, adjustments have been made to the 941 report in Dominion VUE to assist you in completing IRS Form 941.

The IRS has provided you a link to IRS 941 Instructions and a link to the revised Form 941.

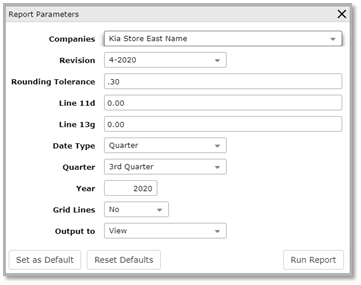

In VUE, find new Report Parameters in Payroll > Reports > Quarterly Reports >941.

New report parameters

•Revisions

o 4-2020

-The report parameters default to Revision 4-2020

-When Revision 4-2020 is selected, Quarter 2, 3, or 4 should be used

o 1-2020

-When Revision 1-2020 is selected, Quarter 1 should be used

• Line 11d

o This is a freeform field to enter the dollar amount to be used on line 11d.

• Line 13g

o This is a freeform field to enter the dollar amount to be used on line 13g.

• or modified lines on the VUE 941 report

o 5a(i) *

o 5a(ii) *

o 5e

o 11d

o 12

o 13g

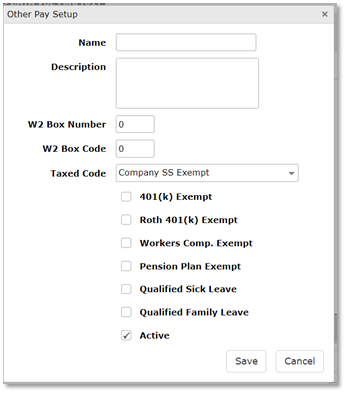

*Maintenance / Setup

Payroll > Maintenance > Company Information on the Misc Other Pay tab.

New Fields:

Other Pays may now be marked as Qualified Sick Leave or Qualified Family Leave.

• The check mark ensures the Other Pay displays on the VUE 941 report line 5a(i) Qualified sick leave or 5a(ii) Qualified family leave.

Click on the [Add Other Pay] button to open the Other Pay Setup window. In the Taxed Code dropdown, the Company SS Exempt option has been added. This taxed code must be used when Qualified Sick Leave or Qualified Family Leave are selected to exclude the wages from taxable wages for the company portion of Social Security. Verify the Other Pays are marked as Active.

If the dealership has already paid wages in the second quarter that were Qualified Sick Leave or Qualified Family Leave wages as defined by the IRS, you should make a prior period entry to adjust the company portion of Social Security. Client Services can walk you through making this entry.

Did this answer your question?