Create, Edit or Add a Lender Record

Create, Edit, and Add a Lender Record in VUE

VUE is a permissions-driven system that tailors security access to suit each users needs. Access to each menu item is managed by an Administrator at your dealership.

See the Permissions Reference Guide to understand what permissions to assign.

Navigate to: Sales > Maintenance > Sales > Lenders

Inside the Primary Grid:

-

Filter/Sort the primary grid to locate the Lending Company.

-

Click [New] in the Action Ribbon to add a New Lender

-

Assign a Lender Code.

-

Click [Create].

- Add/Update the Lender information following the instructions below.

- Lender Contact Information

- Lender Specifications

- Sale (Finance) Set Up Information

- Lease Set Up Information

- Payment Allow/Dealer Loan Fee/Markup/Participation Factor

- Lender Header Bar

Lender Contact Information

-

Add/Update the Full Name of the Lender (this will appear throughout VUE as the lender name)

- Add a Contact name at the Lender (if necessary)

- Add address and phone information.

-

The Address Line 1 hyperlink opens a list of addresses for this lender. Click the caret to edit additional details for a specific address.

-

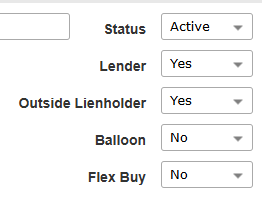

Lender Specifications

Status: (Active/Inactive) - Is the lender active or inactive.

Lender: (Yes/No) - Is the dealership using this lender.

Outside Lienholder: Is this lender also an outside lienholder on a Cash deal.

Balloon: Does this lender offer Balloon contracting.

Flex Buy: Does this lender offer flexbuy option. Usually only with Ford Motor Credit.

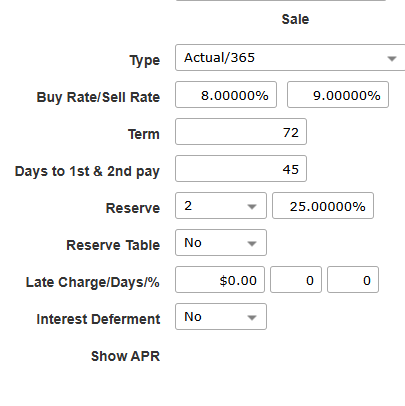

Sale (Finance) Set Up Information

Type (Sale)

Actual To First: Interest calculated from purchase to first payment

Actual/365: Interest calculated on 365 days a year, but flexible for leap year.

Actual/365 Fixed: Interest calculated on 365 days a year, fixed regardless of leap year.

Actual To First (Hyundai/Genesis): Interested calculated on 360 day calendar.

Buy Rate/Sell Rate (Sale): The buy rate is the rate you buy from lender and the sale rate is the rate you sell to customer.

Term: The default setting for the length of contract.

Days to 1st and 2nd pay: The days when the first payment and second payment is due.

Reserve (Sale)

Review the Setting the Reserve Calculations document for detailed information.

Late Charge/Days/%

Late charges the lender charges by flate amount, days until late (grace period), percent of based on remaining amount financed.

Interest Deferment

Allows the lender to be configured for 0% interest rate for a certain amount of time after purchase (e.g., the 0% APR for the first 60 days after purchase). Enabling will then make the First Payment label in the Desk/Deal a hyperlink with a new popup for the # of days of deferment

Lease Set Up Information

Lease Type

No Lease: If lender does not offer leasing.

MRF: Money Rate Factor

Type (APR): APR: Annual Percentage Rate applied to a leasecontract.

Type (Hybrid): A hybrid interest calculation specifically for certain OEM's (e.g., Hyundai)

Buy Rate/Sell Rate (As money factor or interest percentage): The buy rate is the rate you buy from lender and the sale rate is the rate you sell to customer.

Term (Lease): The default setting for the length of contract.

Days to 1st and 2nd pay (Sale): The days when the first payment and second payment is due.

Reserve (LEASE)

Review the Setting the Reserve Calculations document for detailed information.

Late Charge/Days/%

Late charges the lender charges by flate amount, days until late (grace period), percent of based on remaining amount financed.

Payment Allow/Dealer Loan Fee/Markup/Participation Factor

- First Day Payment Allowed: Default day when the first day payment is allowed by lender.

- Last Day Payment Allowed: Default day when the last day payment is allowed by lender.

- Dealer Loan Fee: The fee the lender charges to the dealer.

- FEID: Federal Employer Identification Number.

- Maximum Reserve Markup: The maximum amount the lender will allow the dealer to mark up the loan.

- Dealer Participation Factor: value used by lenders to calculate the portion of a finance or lease markup that the dealership can keep as profit.

Lender Header Bar

New: Create a New Lender Record

Search: Search for other Lender Records

Save: Save updates to the record

Navigate: Use to toggle through the list of Lender records

Fees: Use to attach specific fees to a Lender. Review the documentation on Creating a Lender Fee and Attaching Lender Fees.

Taxes: Use to apply certain taxes to a Lender. Review the documentation on Marking Tax as a Lender Tax and Attaching Lender Taxes.

Flat Rate: Use to create a Flat Rate table. Review the documentation on Adding a Flat Rate Table (Lender).

Lease Extras: Use to add specific Lease criteria for the lender (if applicable. Review the documentation on Updating Lease Extras: Updating Lease Details to Lender Defaults.

State Specific: Use to apply this Lender information to a specific state.

Once done, click [Save] in the Action Ribbon.

Update Lender records in this same manner moving forward.

Did this answer your question?